44+ how much of gross pay should go to mortgage

Web When all things are considered like your debt down payment and mortgage rate you might find you could borrow as much as 6 or 7 times your salary for a. Web But there are two other models that can be used.

First Community Mortgage Home Facebook

The 28 rule isnt universal.

. Web The Bottom Line. Web The income needed to qualify for a 200000 mortgage depends on the mortgage payment amount and how much you pay monthly toward non-housing debt. 5 Best House Loan Lenders Compared Reviewed.

Calculate Your Payment with 0 Down. Web The 3545 Model. Keep your mortgage payment at 28 of your gross monthly income or lower.

Web If you pay 1500 a month for your mortgage and another 100 a month for an auto loan and 400 a month for the rest of your debts your monthly debt payments. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Keep your total monthly debts including your mortgage.

NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Best Mortgage Lenders in California. Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Figure out 25 of your take-home pay. Compare More Than Just Rates. Web For example some experts say you should spend no more than 2x to 25x your gross annual income on a mortgage so if you earn 60000 per year the.

Calculate Your Payment with 0 Down. To calculate how much house you can afford use the 25 rule. Most lenders do not want your monthly.

Find A Lender That Offers Great Service. Web The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg. Comparisons Trusted by 55000000.

Find A Lender That Offers Great Service. Web The housing expense or front-end ratio is determined by the amount of your gross income used to pay your monthly mortgage payment. Web Following Kaplans 25 percent rule a more reasonable housing budget would be 1400 per month.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Never spend more than 25 of your monthly take-home. So taking into account homeowners insurance and property taxes.

Veterans Use This Powerful VA Loan Benefit For Your Next Home. Apply Get Pre-Qualified in 3 Minutes. Web This means that no more than 28 of your monthly income should go to your mortgage payment every month.

Your total monthly inescapable obligations including PITI should be 35 or less of your pre-tax gross. Some financial experts recommend other percentage models like the 3545 model. This rule says you.

Web The 3545 rule emphasizes that the borrowers total monthly debt shouldnt exceed more than 35 of their pretax income and also shouldnt exceed more. NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Principal interest taxes and insurance.

Web The 2836 rule stipulates that in order for a home to be considered within your budget your housing expenses such as mortgage payments taxes and insurance. Say youre making 4648 every month. Compare More Than Just Rates.

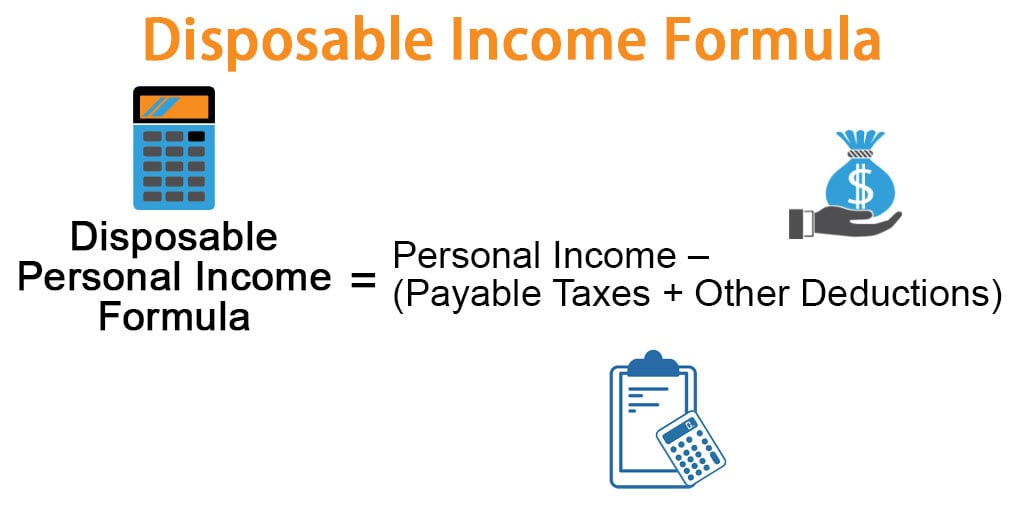

Disposable Income Formula Examples With Excel Template

What Percentage Of Income Should Go To A Mortgage Bankrate

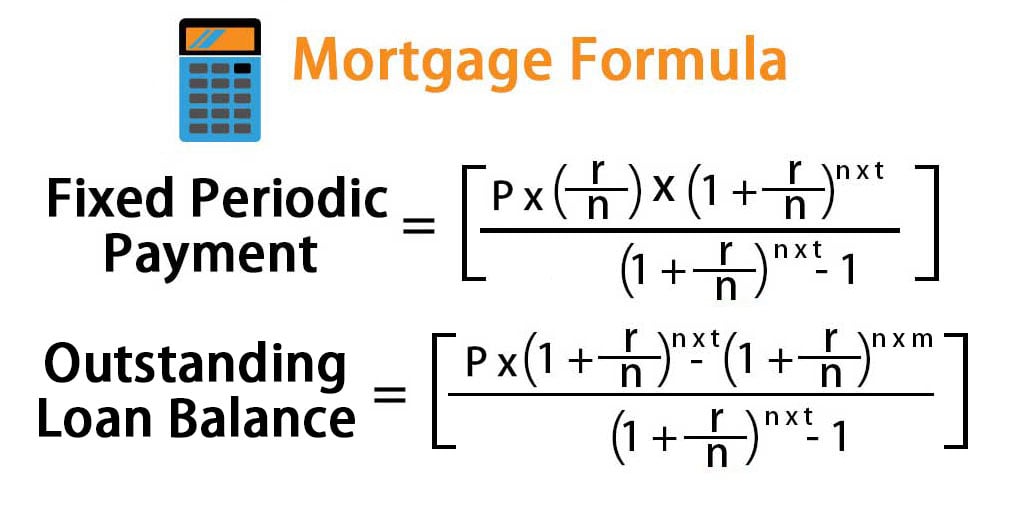

Amortized Loan Formula Calculator Example With Excel Template

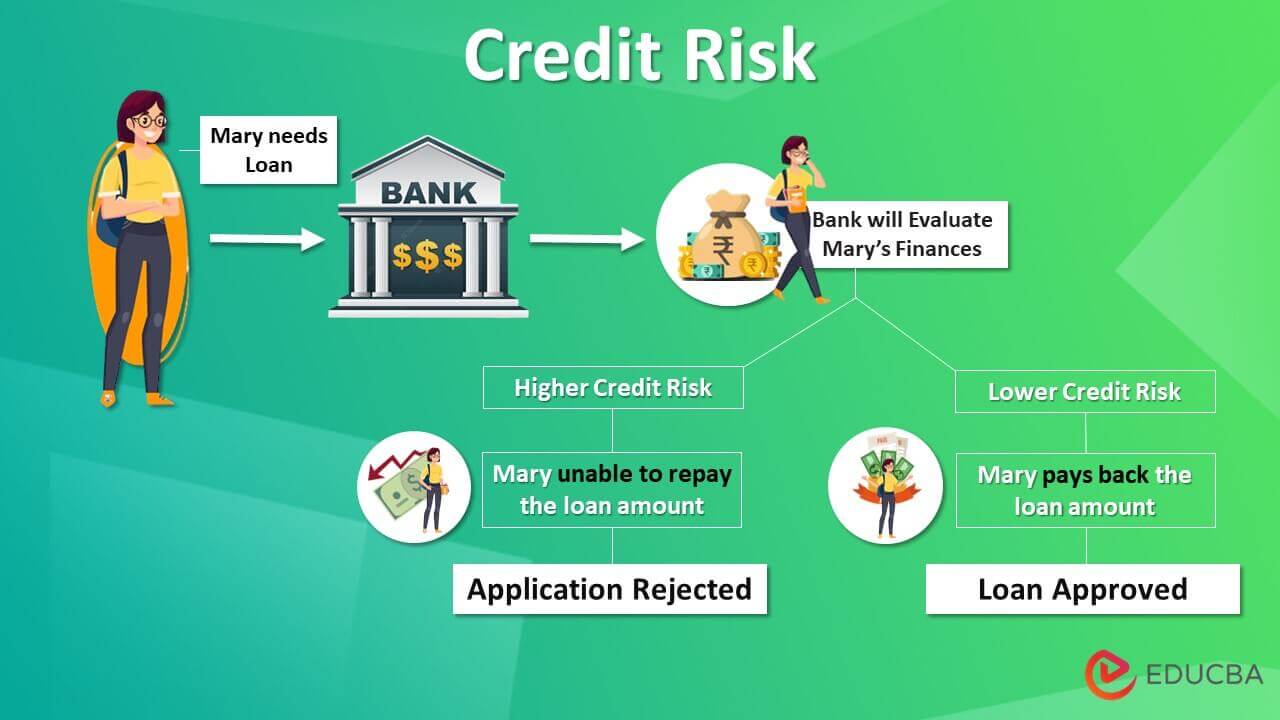

Credit Risk How To Measure Credit Risk With Types And Uses

Gross Salary Vs Net Salary Top 6 Differences With Infographics

How Much Of My Income Should Go Towards A Mortgage Payment

Your Mortgage Should Not Exceed 2 5x Gross Income By Pendora The Startup Medium

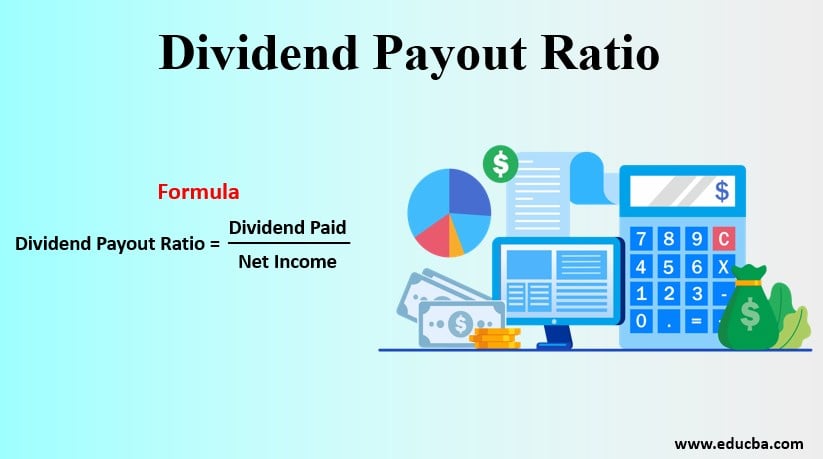

Dividend Payout Ratio Importance Limitation Of Dividend Payout Ratio

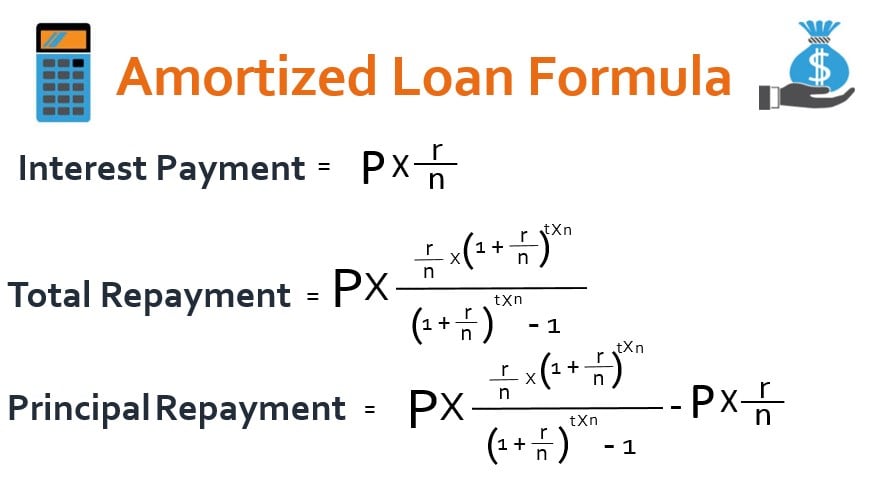

Loan Vs Mortgage Top 7 Best Differences With Infographics

Salary Formula Calculate Salary Calculator Excel Template

Q A Canva Template Canva Templates Creative Market

Gross Profit Percentage Top 3 Examples With Excel Template

How Much House Can I Afford Moneyunder30

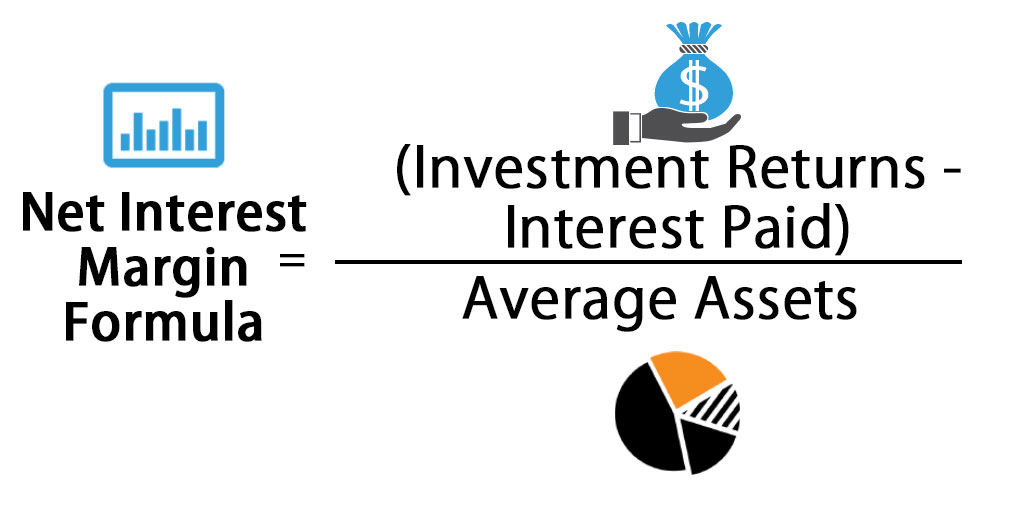

Net Interest Margin Formula Calculator Excel Template

What Percentage Of Income Should Go To Mortgage Morty

How Much House Can You Afford Calculator Cnet Cnet

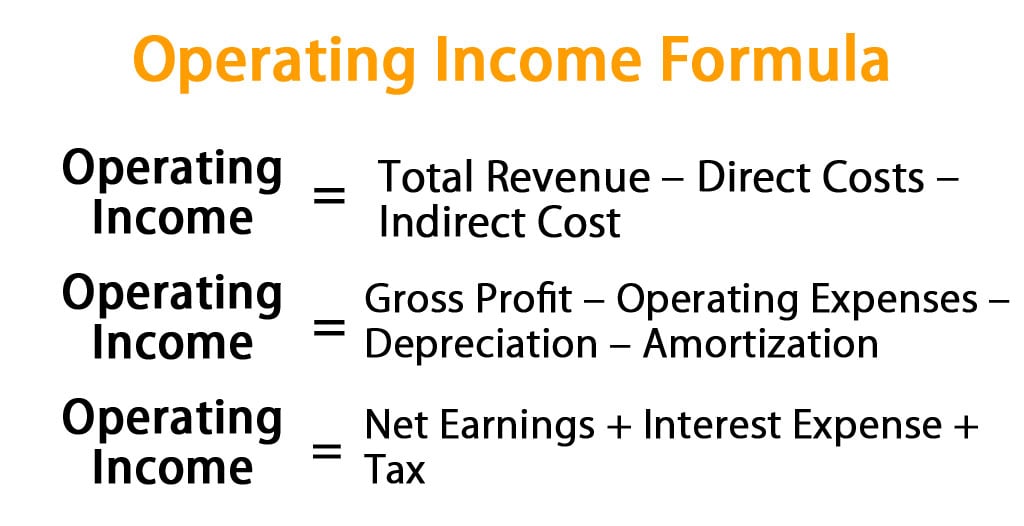

Operating Income Formula Calculator Excel Template